Wearable customer segmentation: Using maturity level for nuanced customer analysis

Customer Maturity Model

Customer Maturity Model

It’s not really possible to do good, quality market analysis in the wearable space (or perhaps any space) without taking into account both user-type (which really defines the use case) and also something I like to refer to as maturity level. I further refine this by looking at maturity across four dimensions:

- QS (Quantified Self) Level (how data-ready the person is)

- Sport Level (to what level they perform their activities and sports)

- Guidance Level (what level of education or coaching they seek)

- Value Level (what the user is willing to pay)

QS Level:

Not all athletes are quantified self nerds. I’d argue that the majority are not and that there’s even a generation gap and sport-specific gap in who is and is not a data junkie.

Here is an example of dashboards built for different QS level customers:

Left to right: Fitbit Dashboard (QS level 2), Garmin Connect Dashboard (QS level 3), Training Peaks dashboard (QS level 4)

Sport Level:

Not all athletes perform their sport at the same level (obviously) and this impacts the data they require, the functional requirements of the wearable and the harshness of the training environment.

Guidance Level:

People have very different needs for guidance from the very general to the very personal and everything in between.

Value Level:

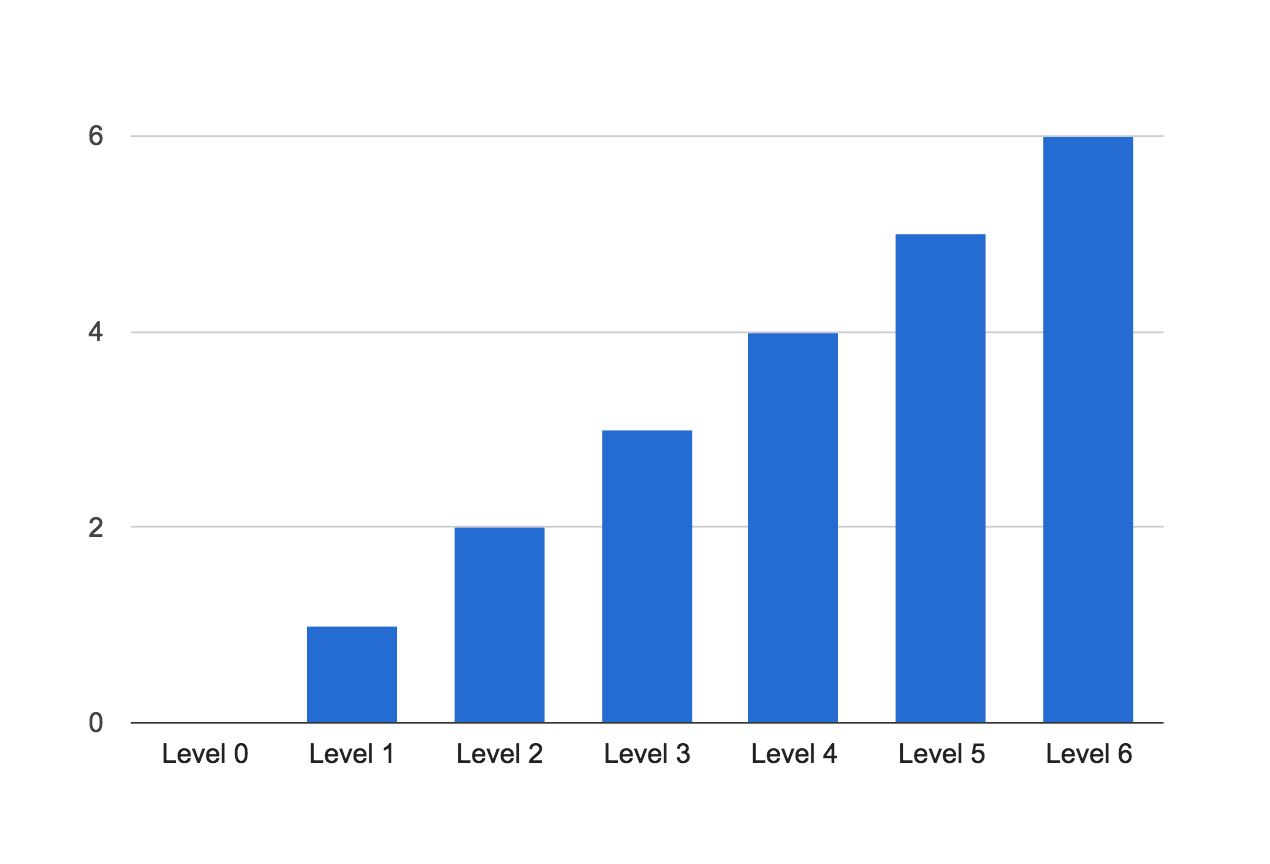

People value wearable tech and tools differently depending on their psychology. The numbers below are intended only to show “order of magnitude difference” and obviously vary case-by-case.

Clustering the characteristics

I think that for simplicity sake, in the case of mass populations, it’s fair to cluster these maturity levels together and say that “in general”, in large populations, there is a large overlap between them such that you could say that somebody is a “Level 3” and understand that to mean that they are likely level 3 across all characteristics:

The reason for this is that now we can start to analyze products in the marketplace not just by their user-type but also by their “user-level”. In the table below (a subset of a much larger table I’ve built to map the wearable market), I’m showing an example of analyzing where a number of different apps and devices fit in the market: Basis Peak, Strava, OM Signal biometrics clothing, Garmin Fenix 3 sport watch, Apple Watch, Garmin 920XT multi-sport watch, FitBit Surge HR fitness watch, and FitBit ChargeHR activity tracker.

What you will see is that it’s possible to map product/market fit not only by use-case (upper bar) but also by overall “level” where the levels are assumed to roughly correlate. In other words, for simplicity sake, you can assume that a QS level 3 person is probably also a level 3 serious athlete, who wants level 3 semi-personalized guidance from a coach and who is willing to spend level 3 dollars to get their training support. Obviously humans are messier than that at an individual level but then for a single person you could always say they are a level 5 competitive triathlete who is QS 0. But that’s not helpful for market analysis.

What can we learn from this kind of chart?

Here are a few conclusions I could draw from this type of chart. Obviously some people could argue that one cell or another might be a yes vs. a maybe but overall, there are some broad patterns that become obvious.

- Basis peak is okay for Level 2-4 walkers and joggers and level 2 runners and cyclists. Why not level 3-4 runners and cyclists? The device is terrible at pulling high-quality data when in motion and a level 3+ QS person or athlete won’t stand for it.

- Strava is growing quickly because they focused so heavily on serving the entire range of cyclists (both recreational and competitive class) from level 1-5.

- OmSignal is going to have a hard go of it because it fits so few user types and levels. It’s a narrow total addressable market because athetes are very sensitive to the textiles they want to use, and the data that it throws off in version 1.0 is very minimal, good enough for a QS level 1 person but not much more.

- The new Garmin Fenix 3 and Garmin 920XT have a large total addressable market of anybody who is level 2 or up across a wide variety of sports.

- The sweet spot covered by the Garmins noted above is entirely different than the sweet spot for the smart watches and activity trackers like Apple Watch and Fitbit.

- The Apple Watch, Fitbit Surge HR and FitBit Charge HR are really competing for similar audiences. Probably the primary determining factors in terms of purchase choice will be things like battery life, need for additional applications, and price.

I’d love to hear your thoughts on this model and if it works or doesn’t work, or what you think is missing. Feel free to leave a comment at the bottom of this post.

As always, thanks for reading, sharing, and commenting.